An adjustment journal is a journal created in the process of recording changes in balances in an account so that the balance reflects the actual amount. In general, the function of the adjusting journal entry is to determine the general ledger account balance at the end of the period and to calculate income and expenses for the period concerned. Below, we will explain a few things about adjusting entries and how they are recorded. Look at prepaid expense journal entry website for more information about prepaid expense journal entry.

Accounts that need adjustment at the end of the period

- Equipment account, which requires changes due to usage.

- Expense accounts are prepaid, which requires an adjustment because time has passed/is due.

- Fixed assets account, which requires a change because there is an asset depreciation.

- Income account, i.e., requires an adjustment because there is income that has not been calculated or revenue that has not yet been income.

- expense account, which requires a change because there are expenses that have not been calculated or payments that have not yet been charged.

- Earnings accounts are received in advance, which requires adjustments due to the passage of time or the submission of achievements to the customer.

Example of writing an adjusting journal

1. The equipment account shows a temporary balance of IDR 500,000. While the end of period data indicates that there is still a balance of Rp. 200,000.

Analysis:

Equipment account (balance on the debit side).

Then the amount used is calculated on the debit side of the load, which is Rp. 500,000 – Rp. 200,000 = Rp. 300,000. Then, record the IDR 300,000 equipment expense account on the debit side and reduce the number of equipment accounts to IDR 300,000 and so on the credit side.

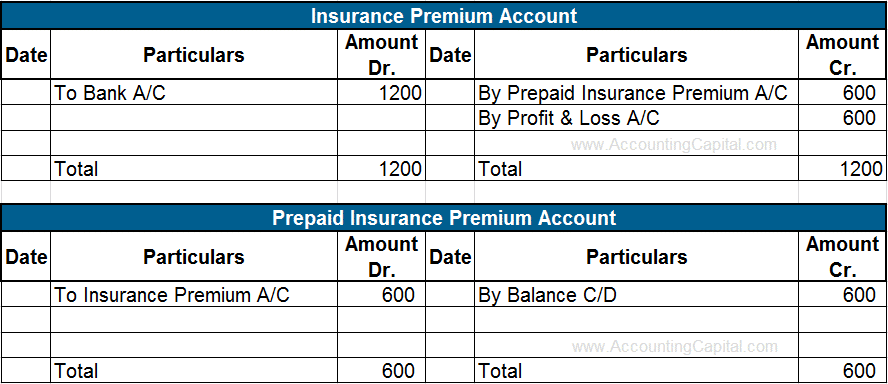

2. The prepaid insurance account shows a temporary balance of IDR 360,000.

End of period data: the amount of insurance that is due is Rp120,000 for four months.

Analysis:

The insurance account is paid in advance (the balance is on the debit side), recorded as assets. What is recorded for adjustment is the amount that has become a burden (i.e., the amount that is past due / already traveled)?

Insurance expense of Rp120,000 on the debit side. Then in the prepaid insurance account, Rp120,000 recorded on the credit side.

3. The equipment account shows a balance of Rp 3,000,000. At the end of the period: the equipment is depreciated by 10%.

Analysis:

Equipment account (balance on the debit side). Depreciation of equipment 10% x Rp. 3,000,000 = Rp. 300,000 is recorded as depreciation expense on the debit side. Then in the account of accumulated depreciation of equipment recorded Rp.300,000 on the credit side to accommodate each depreciation of equipment annually.

The service income account shows the amount of Rp1,800,000 — end of period data from the revenue of Rp. 200,000 services to subscriptions have not been worked on.

Analysis:

Service income account (balance on the credit side). The total income that has not yet become income is Rp. 200,000 because the work/service to the subscription has not been done. So subtract the Rp200,000 service income account and record it on the debit side. Then log it in the income account received in advance Rp.200,000 on the credit side because it is considered as debt.

NDA Partnering Blogs: submit article health