Income Accrued or Accrued Income is income earned for the accounting year concerned but has not been received at the close of the fiscal year because the date of receipt/billing has not yet matured.

Example:

August 1, 2009, Company X bought 24% of PT Y Bonds with a nominal value of Rp. 100,000,000.00 interest is received every February and 1 August.

Answer:

- Transaction Journal

PT Y Bonds are Rp 100,000,000.00

Cash Rp 100,000,000.00

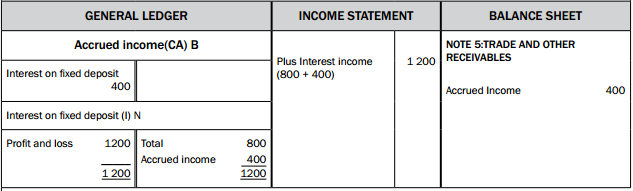

- Journal of Adjustment

August 1 – December 31 = 5 months

5/12 x 24% x Rp 100,000,000.00 = Rp 10,000,000.00

The accrued income is IDR 10,000,000.00

Interest income of IDR 10,000,000.00

- Turning Journal

Interest income of IDR 10,000,000.00

Income Accrued Rp. 10,000,000

- Journal of Interest Receipts

Cash Rp. 12,000,000.00

Interest income of Rp 12,000,000.00

Definition of Accrual Payable

The Definition of Accrual Payable is:

The company must pay costs to other parties or services that have been carried out by other parties for the benefit of the company. These costs are the company’s obligation to pay but have not been paid by the company, so it is still a debt or obligation that must be borne by the company to pay it off.

Examples of Accrual Payable costs include:

Salary debt

As of December 31, there were still employee salary costs that the company had not yet paid.

Electricity Debt

As of December 31, there were still electricity usage costs that the company had not yet paid.

Phone Debt

As of December 31, there were still telephone costs that the company had not yet paid for.

Water Debt

As of December 31, there were still water purchase costs (from PDAM) that the company had not yet paid.

Income Tax Debt

As of December 31, there are still company income tax costs that have not been paid by the company.

Bank Interest Debt

As of December 31, there are still bank interest costs that have not been paid by the company.

Understand Adjustment Journal

An adjustment journal is a journal used to adjust the value in a trial balance. While the balance sheet itself is an accumulation in the accounting period. What is accumulated is the initial balance sheet and the transactions that occur.

Another definition states, adjusting entries are journals created in the process of recording changes in balances in an account so that they reflect the actual amount.

There are several functions. First, to determine the general ledger account balance at the end of the period. Next, to calculate income and expenses during the period.

In it, it has also known journal entries. What is meant by a journal entry is a journal created as a material for change in this journal. Or as a process of recording changes in balance. It is originating from several accounts so that it reflects the actual amount of stability.

Another function is to complete accounting records. You are especially accounting records or economic activities of the company. But they are not recorded in the transaction journal — for example, depreciation journal.

Depreciation journals are not recorded in transaction journals. Because it does not include the results of the transaction, and adjusting entry can also be referred to as a company journal in allocating assets to costs.

In addition to function, there is also the purpose of making it. Short adjusting entries are intended to ensure the truth of the data. Or in more detail, it aims to show the reality of each estimate — accurately, the estimated debt and assets at the end of the period.

The next goal is to show the nominal for each estimate. What estimate is meant? Estimated end of period revenue and expenses. That will show the amount of income and fees that must be recognized.

NDA Partnering Blogs: submit a guest post