Rising costs have made it increasingly difficult to meet all expenses. This coupled with the economic slowdown means that your income is not enough to pay for your every need, thus, prompting the need to take a loan. However, you may not be able to offer collateral to secure the loan amount, which means that you will have to apply for unsecured loans.

As we know that personal loans are unsecured and can be availed at affordable interest rates. However, easy accessibility to personal loans by numerous lending institutions has caused prospective customers to make innocuous borrowing mistakes that have cost them in the long run. However, following certain essential rules before filling up the loan application helps. These include:

Rules To Follow While Availing Personal Loan:

- Borrow Only What You Need: Just because personal loans are affordable, it does not mean that you apply for an amount more than you can repay. Seek the amount that you need and not what you want. As numerous lending institutions race against each other to approve and disburse loans to their customers, you may unnecessarily feel compelled to opt for a high loan amount.

- Choose A Short Loan Tenure: Lenders offer a loan tenure between six months and five years. Some lenders also offer a tenure as long as 30 years, thus, allowing their customers to pay lower equated monthly instalments (EMIs). However, choosing a long tenure also means that you end up paying more interest while repaying your loan. It is a preference to go for a smaller loan tenure so that you may repay the entire loan without bearing the burden of excess interest payments.

- Ensure timely payments: Paying back the loan amount on time and with regular frequency ensures complete repayment of the loan in time, thus, enhancing your credit score. Your credit score stems from your repayment history of previous or existing loans. A good credit history allows increased scope for approval of loans and credit cards in future.

- Don’t Invest With Borrowed Money: A common mistake that many people make is that they invest with borrowed money.Most investments do not fetch returns equal to or greater than your loan interest rates. Putting the money into equities means that you are subjecting the borrowed money to the ups and downs of volatile markets.Try avoiding a personal loan to make investments.

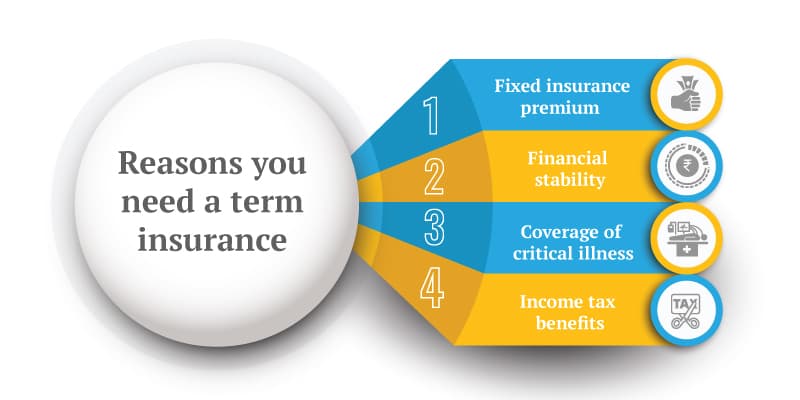

- Be Insured If Your Loan Is Big: Taking a big loan amount means saddling a big liability that your dependents may have to bear in the event of your unfortunate demise. If you have sought a big-ticket loan, ensure that you buy a term insurance plan with an insured amount equal to the loan amount so that your family members may pay off the loan immediately after your death.

- Scan Lenders’ Interests Online: Lenders offer varying interest rates on personal loans for salaried and self-employed. Before choosing your lender, check the interest rates offered by each and apply to the one that avails your choice of the loan amount at low-interest rates.

- Read Loan Documents Carefully:Many borrowers complain that they had not been aware of the lenders’ terms and conditions while signing the loan agreement document. Before accepting the loan amount, read the fine print carefully and check for details that you don’t understand.

- Consolidate Debt: Credit card loans cost higher.Similarly, the interest on credit card debt is high. Instead of spending your earnings on loan repayment, take a personal loan to repay all those hi-end loans. This will ensure repayment of all liabilities at lower charges.

- Don’t Leave Behind Liabilities: Some people take personal loans at a later stage to pay for their children’s education. This often results in children bearing the brunt of the loan later. You can pay for your children’s education with your retirement corpus or tell them to take loans to fund their education.

- Keep Your Family Informed About The Loan:Tell your family about the loan that you intend to take as the debt repayment would affect the finances of your family.

Hence, these are some important things or you can say that rules must be followed while applying for the personal loan. But before applying must fulfill the personal loan eligibility criteria and documentation. At the end if you follow all the steps for applying personal loan correctly your loan application will be approved.